Trusted Partners Who Work For You

Imagine if years before you ever realized that you needed to make a real estate decision, a firm had been practicing and learning and building an entire organization around helping you make that decision excellently. That’s us. Welcome.

Brokerage Services

With access to cutting-edge mapping tech and deep market knowledge, our brokers provide clarity to clients – helping them make strategic decisions faster.

Consulting Services

With DTSpade, you have specialized experts as your partner through every stage — from the day your doors open, to the day it’s time to open more doors.

Additional Resources

By focusing on specific practices and sectors, our brokers have built a wealth of commercial real estate expertise – we want to share it with you.

Smart Tools.

Educated Decisions.

We all have data, but can you turn that into information?

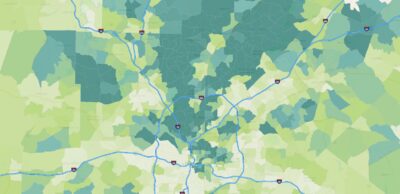

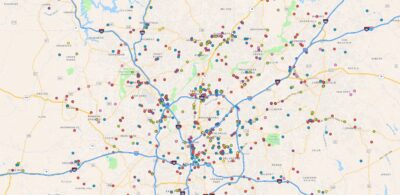

We work with clients to clarify, prioritize, and strategize. This begins with putting the project or subject area into context. We are able to do so by leveraging powerful GIS mapping tools along with multiple data sources.

Data-driven real estate solutions, like this one, show where particular consumer habits occur and which markets hold the most promise for your next location.

Curious how the real estate market in your area is going to affect your upcoming purchase, sale or expansion? Fill out the form below to get a free 3 page report on your submarket.

Site Selection Map

By overlaying multiple data sets we help our clients find the best possible locations.

HH Income Layer

Service Provider Layer

Population Density Layer

Free Submarket Report

"*" indicates required fields

Specialization Is

Our Advantage

DTSpade provides specialized real estate brokerage services to Clients in targeted Channels to help them make an excellent decision.

By “staying within our lane” we pre-select the transactions that we would like to represent, and by sowing into those channels, we are an unbeatable competitor. Understanding your needs, building a business around a single decision you have to make, and practicing that over and over again gives us success.

As a byproduct of our focus on specific channels, we have the luxury of building custom solutions, resources, and financial models around each of our areas of focus.

Healthcare

- Hospital Systems

- Urgent Care Facilities

- Ambulatory Surgery Centers

View More

- Community hospitals

- Health centers

- Skilled nursing facilities

- Independent living

- Long-term care facilities

- Assisted living

- Continuing care retirement communities

- Land development for healthcare facilities

Pre-Equity

- Hospitality/Restaurant Groups

- Industrial/Warehouse

- Land Assemblage

View More

- DSO’s

- Industrial

- Transportation & Logistics

Dental

- General Dentist

- Pediatric Dentist

- Orthodontist

View More

- Periodontist

- Endodontist

- Oral Pathologist

- Oral Surgeon

- Prosthodontist

Service

- Government Entities

- Nonprofit Organizations

- Education Systems/Schools

View More

- Consolates & Missions

- Nonprofit Organizations

- Religious Facilities

- Education Systems and Private Schools

Medical

- Medical Office Buildings

- Laboratories

- Surgery Centers

View More

- Ambulatory Care

- Chiropractic

- Fitness

- Managed Care Practices

- Orthopedics

- Pain Management

- Pharmacy

- Physical Therapy

- Surgery Centers

- Veterinary

- Vision Care

DTSpade By The Numbers

North American Offices

Service Hours

State Brokerage Licenses

Clients Represented

Transacted

Global Partners

Locations

ATLANTA – HEADQUARTERS

900 Circle 75 Pkwy • Suite 1350 Atlanta, GA 30339

404.939.9500

PHILADELPHIA

1635 Market St • Suite 1600 Philadelphia, PA 19103

267.521.1200

HACKENSACK

2 University Plaza • Suite 100 Hackensack, NJ 07601

201.264.4863